A salary slip, or payslip, is something every employee receives each month, whether you work in a tech giant like Grab or a bank like DBS. It may look routine, but it is one of the most important records of your professional life. It reflects your total earnings, deductions, and net pay, and is often required when applying for loans, filing taxes, or moving to a new role.

What is Salary Slip?

Salary slip means a monthly document issued by an employer that outlines your salary components. It is divided into two broad parts. One lists the money you earn, basic pay, allowances, and bonuses. The other lists the deductions such as provident fund, professional tax, and income tax. What remains is your net salary, which goes into your bank account.

The salary slip meaning is simple. It is proof of how much you earn and what obligations you have towards statutory payments like PF or TDS. For the employee, it works as income proof, while for the employer, it is an official record of compliance. Some firms call it a payslip or payment slip, but it all refers to the same document.

Also Read: Difference Between CTC vs In-Hand Salary

Monthly Salary Slip Format PDF

Most companies today issue a salary slip format pdf that you can download directly from the Human Resource Management System (HRMS) or payroll system. It is a secure, ready-to-share file that works well for banks, financial institutions, and background verification checks.

A standard salary slip format pdf usually includes:

- Header details: Company name, address, payslip month and year, employee name, ID, department, designation, PAN, UAN, and bank details.

- Earnings: Basic pay, house rent allowance, conveyance, special allowance, Leave Travel Allowance (LTA), bonus, and incentives.

- Deductions: Provident fund, Employees’ State Insurance (ESI), professional tax, income tax (TDS), and other company deductions.

- Summary: Gross pay, total deductions, and net pay.

If your organisation does not provide a payslip, you can always create a record for yourself using a simple salary slip format in Excel. Many people keep a salary slip sample format ready so they can cross-check with their official statement.

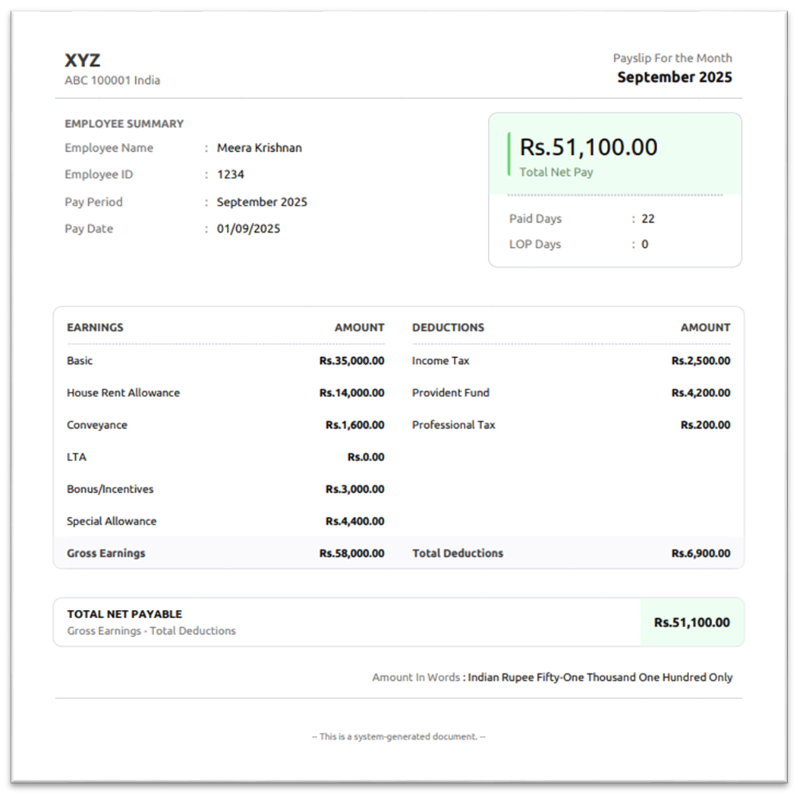

Salary Slip Format Example

Here is a salary slip example that is similar to what most private companies issue:

This kind of salary slip format example is easy to understand and reflects both statutory and company deductions.

Also Read: What is Payroll? — Components, Process & How to Calculate

How to Download Salary Slip

Getting your monthly pay slip is usually straightforward if your company uses an HR portal. Here’s how employees typically do it:

- Log in to the HRMS or payroll portal.

- Find the section labelled Payroll or Salary.

- Choose the month and year.

- Click on View or Download Salary Slip.

- Save the file as a pdf or take a print.

- Double-check all the details before you share it.

- If there is a mistake, raise it with HR immediately.

Some organisations also email the monthly salary slip to employees, while smaller firms may hand over a printed copy.

Components of Salary Slip

Every payslip has a set of earnings and deductions. Here is what you will generally see in the components of salary slip:

Earnings

- Basic Pay: Fixed portion of your salary that forms the base for most calculations.

- HRA: House rent allowance, partly tax-exempt if you live in rented accommodation.

- Conveyance: Allowance for commuting costs.

- Special Allowance: A balancing element added to fit the company’s CTC structure.

- LTA: Allowance to cover domestic travel, available only when bills are submitted.

- Bonus or Incentives: Linked to performance or company policy.

Deductions

- PF: Provident fund contribution made by the employee.

- ESI: Insurance deduction for eligible employees.

- Professional Tax: State-imposed tax in certain states.

- Income Tax (TDS): Deducted at source by the employer as per tax rules.

- Other deductions: Loans or advances, if any.

Summary

- Gross Salary: Total earnings before deductions.

- Total Deductions: Sum of all statutory and voluntary cuts.

- Net Salary: In-hand salary that is transferred to your bank account.

Knowing the details of each component of salary slip helps you manage taxes better and claim exemptions wherever possible.

Also Read: Salary Break-up Format : Salary structure & Other Components

Importance of Salary Slip

Employees often treat their payslip casually, but it is an important document in many real-world situations. A few examples:

- Banks will ask for your monthly salary slip when you apply for a home or car loan.

- Tax consultants use it to calculate your liability and suggest investment options.

- New employers check monthly pay slips to verify your last drawn pay before making an offer.

- Visa authorities or landlords may ask for it as proof of income.

- It shows whether statutory deductions like PF and ESI are being made correctly.

Without a proper monthly pay slip, you could face problems in proving your income, planning taxes, or negotiating for better pay.

Also Read: 8 Golden Rules of Salary Negotiation

Conclusion

A salary slip is far more than a routine document. It is your official proof of earnings, a record of statutory compliance, and a tool for financial planning. Whether you receive monthly pay slip as a pdf download, an Excel sheet, or a printed copy, treat it with care. Always keep a record of past payslips, review the figures carefully each month, and use them wisely for tax benefits, loans, or future career growth.

Salary Slip FAQs

Q1. Is payslip and salary slip same?

Yes. Both terms mean the same monthly document that records an employee’s earnings and deductions.

Q2. Are handwritten salary slips legal?

Handwritten slips are rare and often not accepted. Most institutions will only consider a computer-generated salary slip format pdf or a stamped company slip.

Q3. Can I use my payslip as proof of income?

Yes. A monthly salary slip is widely accepted as proof of income for loans, rentals, visa applications, and background checks.

Q4. Does a salary slip require a signature?

Digital payslips usually do not. Some employers add a digital stamp or seal, especially if required by a bank.

Q5. How can we get a Salary Slip online?

You can log in to your HRMS portal, select the month, and download the salary slip pdf. If you cannot access it, contact HR.

Q6. What is CA in salary slip?

CA is Conveyance Allowance. It is paid to cover travel expenses and is usually taxable.

Q7. What is the meaning of STD days in salary slip?

STD days refers to Standard Days, meaning the number of working days considered for payroll in that month.